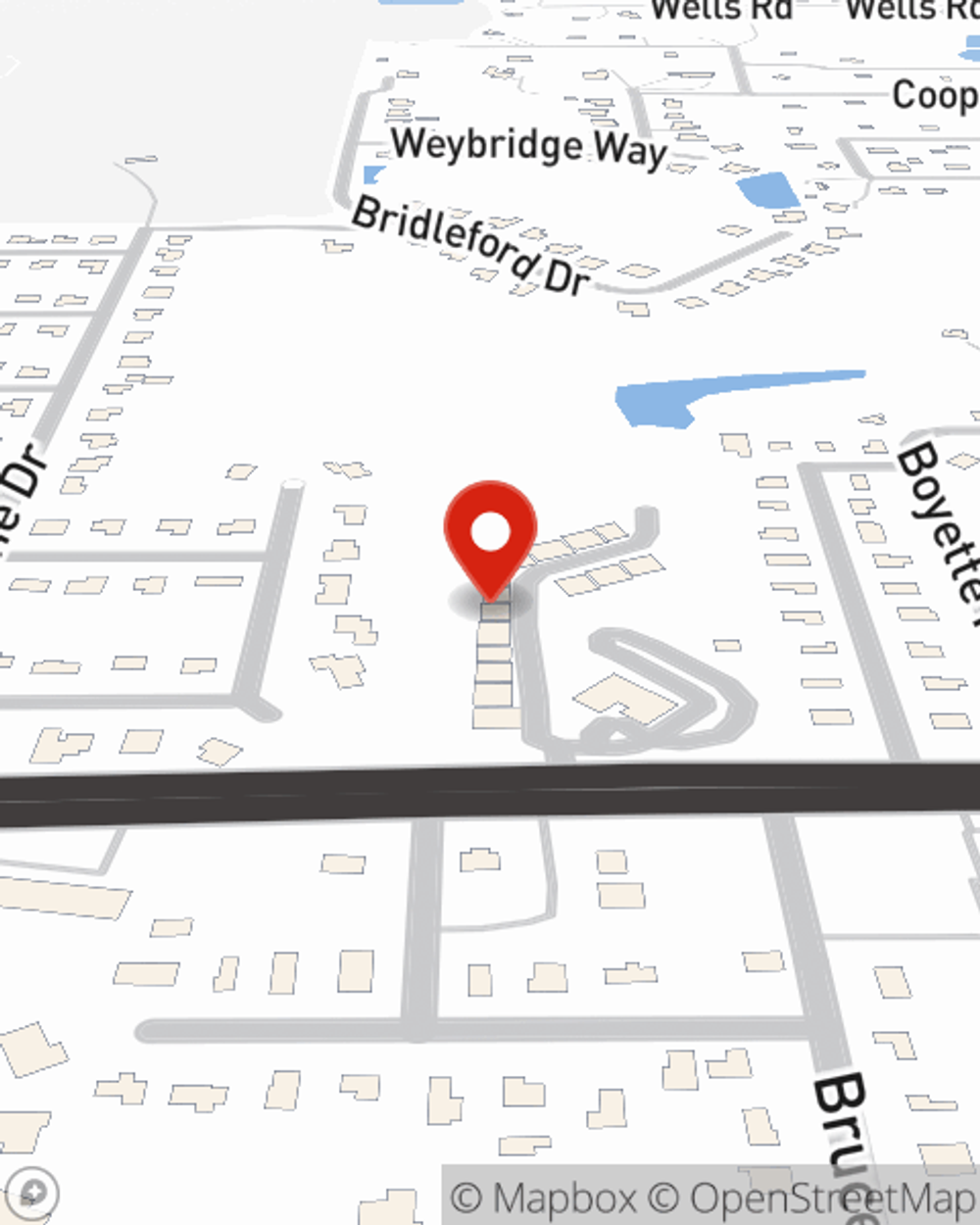

Condo Insurance in and around Wesley Chapel

Here's why you need condo unitowners insurance

Quality coverage for your condo and belongings inside

Calling All Condo Unitowners!

There is much to consider, like coverage options deductibles, and more, when looking for the right condo insurance. With State Farm, this doesn't have to be a difficult decision. Not only is the coverage impressive, but it is also well priced. And that's not all! The coverage can help provide protection for your condominium and also your personal property inside, including things like books, bedroom sets and mementos.

Here's why you need condo unitowners insurance

Quality coverage for your condo and belongings inside

Put Those Worries To Rest

Condo unitowners coverage like this is what sets State Farm apart from the rest. Agent Shirin Khorsandian can be there whenever mishaps occur to help you submit your claim. State Farm is there for you.

That’s why your friends and neighbors in Wesley Chapel turn to State Farm Agent Shirin Khorsandian. Shirin Khorsandian can explain your liabilities and help you find the most appropriate coverage for you.

Have More Questions About Condo Unitowners Insurance?

Call Shirin at (813) 971-6060 or visit our FAQ page.

Simple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

Shirin Khorsandian

State Farm® Insurance AgentSimple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.